General Partner Clawback Provisions In Private Equity Agreements

Reinhart Boerner Van Deuren is a full-service, business-oriented law firm with offices in Milwaukee, Madison, Waukesha and Wausau, Wisconsin; Chicago and Rockford, Illinois; Minneapolis, Minnesota; Denver, Colorado; and Phoenix, Arizona. With nearly 200 lawyers, the firm serves clients throughout the United States and internationally with a combination of legal advice, industry understanding and superior client service.

Most limited partnership agreements for private equity funds have two separate clawback components: the limited partner clawback and the general partner clawback.

United States Corporate/Commercial Law

To print this article, all you need is to be registered or login on Mondaq.com.

Most limited partnership agreements for private equity funds have two separate clawback components: The limited partner clawback and the general partner clawback. This Investor Alert discusses the general partner clawback.

Calculation of General Partner Clawback. General partner clawback provisions can require the general partner to return distributions if any of the following conditions hold true:

- A limited partner has not received its preferred return (generally 8%; sometimes higher, in the 9% to 11% range).

- The general partner has received carried interest in excess of the contractual rate (generally 20%, but often less for real estate funds).

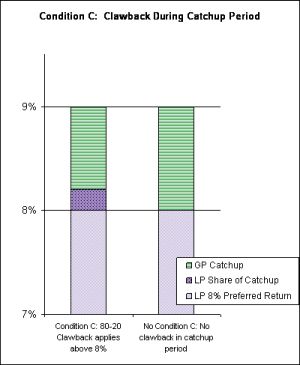

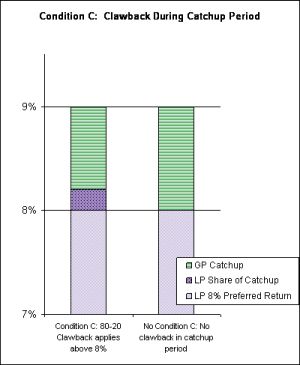

- A limited partner has not received its "catch-up period" share of profits. Generally, after the preferred return, the carried interest is split 20% (to limited partners) and 80% (to general partner) (or in some cases 50-50), until the general partner has received 20% of all profits. (Some funds give the general partner 100% of the profit during this catch-up period; in these funds the limited partner is not entitled to any profit until the general partner has fully "caught up".) The chart on the next page illustratesCondition (C).

In our experience, over 90% of general partners in private equity and real estate funds agree to return distributions if Condition (A) is not met. Over 80% agree to return contributions if Condition (B) is not met. However, less than 10% of the private equity fund agreements that we review provide for a return of unjustly received contributions if Condition (C) is not met.

We believe that a Condition (C) clawback is rarely contained in the partnership agreements because: (1) very few investors request Condition (C) (and so, the pressure from limited partners to include this clawback is low) and (2) the financial benefits from this change are only realized if the fundʼs ultimate IRR is within a narrow band (i.e., above 8%, but below the point at which the general partner has fully "caught up"). We hope that by increasing awareness of the fact that the clawback should also apply to Condition (C), more investors will request this provision and — consequently, more funds will expand their clawback to include this scenario.

In our experience, success in negotiating Condition (C) depends on multiple factors including:

- How clearly the change request is explained to the general partner

- How many other investors also request this change

- The general inclination of the fund to accept change requests

- Whether the distribution formula is non-standard (because with a non-standard distribution formula "everything is on the table")

To aid in explaining and understanding the change request relating to Condition (C), we have prepared the chart below.

This chart assumes that the fund returns 9% with a one-year holding period, and has an 80-20 catch-up for all amounts in excess of an 8% IRR. This chart also assumes that the limited partner was distributed an amount that equates to 8% IRR, and that the general partner was mistakenly distributed all remaining amounts (rather than 80% of remaining amounts). To assess whether a clawback provision would require reallocation of a portion of the amounts previously distributed to the general partner, the following must be considered:

- Condition (A)would not require a clawback, as the limited partners have attained an 8% IRR (which, with a one-year holding period, equals an 8% return). Thus, if Condition (A) is the only clawback provision, the limited partners would receive 8%, and the general partner would receive 1%;

- Condition (B)does not require the clawback, as the limited partners have received 8/9 and the general partner has received 1/9 of total returns. The general partner's share, 1/9, equates to 11.1%. Thus, no clawback because the general partner has not received returns in excess of 20%;

- Condition (C)would, however, require that the general partner return distributions in the amount shown by the middle box in the left column, which is marked "LP Share of Catch-up." This amount reflects the limited partners' right to receive 20% of all distributions above the 8% preferred return, until the general partner has fully "caught up" to the 20-80 split of profits. With this clawback, limited partners would receive 8.2% and the general partner returns its 0.2% overpayment (leaving it with 0.8%). (Without this Condition (C) clawback the limited partners would have received 8.0% and the general partner would have received 1.0%).

Some general partners that we have encountered have taken the position that take the clawback is only meant to address Conditions (A) and (B) — and that a Condition (C) clawback is not something that limited partners are entitled to. However, in our view the purpose of the clawback is to do one "final check" at the end of the fund's life, to make sure that the distributions were paid out in the intended manner — (i.e., that the limited partners do not receive less than they bargained for when the distribution formula was agreed upon). For the "final check" to work, the clawback must match the distribution formula.

Testing and Timing of General Partner Clawback. In most private market funds, the general partner clawback is applied only once, at the end of the fund's life. This means that there is no obligation to return excessive distributions during the life of the fund, but only at the time of dissolution.

Problematically, some funds remain in existence — and do not dissolve — until long after the bulk of their investments have been disposed of, in order to hold (and hopefully sell) the remaining, illiquid securities. In these situations, the clawback calculation and return of excessive distributions, would also be delayed. In addition, limited partners may be asked to extend a fund's term of existence — further delaying the clawback calculation. (Failure to extend may result in an undesirable in-kind distribution of illiquid securities to partners.)

In order to avoid unnecessary delays in the clawback we prefer the following:

- First: We like to see clawback tested on a periodic basis. Some funds have an annual or bi-annual test of the clawback. If testing indicates that a clawback obligation might arise, the fund should make future distributions to the limited partners only (or, at a minimum, escrow the general partner's distributions).

- Second: Toward the end of a fund's life, the clawback calculation should be made once the fund's investments have been predominantly disposed of – and should not be delayed due to the presence of "straggler investments" which cannot be easily disposed.

- Third: Extension of a fund's investment term could be conditioned on "testing" the clawback prior to extension, with a return of previously made distributions if warranted by the clawback terms.

Other Clawback-Related Topics. Other questions to ask in reviewing and negotiating a general partner clawback provision include:

- What are the limits on the general partnerʼs giveback obligations (e.g., while it is generally limited to net after-tax obligations, this limit may not be appropriate if the fund sponsor is a tax-exempt entity such as an insurance company or other institution).

- In situations where the giveback is capped at the after-tax amount, are tax benefits from paying the clawback retained by the general partner (and its members), or transferred to the limited partners? (The tax benefit would generally be a capital loss which could be applied against the same year's capital gains, and carried forward to offset future years' capital gains.)

- Does the provision work accurately even if a limited partner is "excused" from an investment (in which case the returns of the various limited partners will not be the same)? In other words, is the clawback test applied in the aggregate, or on a partner-by-partner basis?

- What form of security is there for the clawback? For example, is there an escrow account (and if so, how is the balance determined)? Is there a guarantee? Does the guarantee stop at the fund sponsor level (i.e., the general partner or management company) or does it extend to the ultimate recipients of the carried interest? And is the guarantee several, or joint and several?

- Are distributions from the fund paid out on a deal-by-deal basis (in which case the clawback is more likely to be needed), or only after all of the investorsʼ capital contributions have been returned?

- If distributions of profit are paid to the general partner only after all paid-in capital has been returned to investors, does there remain the possibility that the limited partners would be required to pay in more capital (which could reduce the IRR and give rise to a general partner clawback)? Such scenarios can arise when there is an indemnification obligation, a "recycle" of earlier investments, and/or follow-on investments.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.